My thoughts on the Apple Credit Card

I applied for the apple credit card with a medium credit score, low credit history, and high income. Right away they gave me a considerate amount. After a year, my credit limit was tripled, and now I five time the credit limit I started at. After using the card for 3 years, here is my review.

Why you should not apply for the Apple credit card

1. Minimum traveling perks

Rewards do not include traveling perks for hotels and plane tickets. For people like me who like tourism, a card with some sort of travel benefits is always appreciated and makes spending more enthusiastic. Moreover, Apple credit card has special merchants with higher cashback rewards such as Panera, Uber, or T-mobile. But there are no specific hotels or airlines included in the extra cashback rewards.

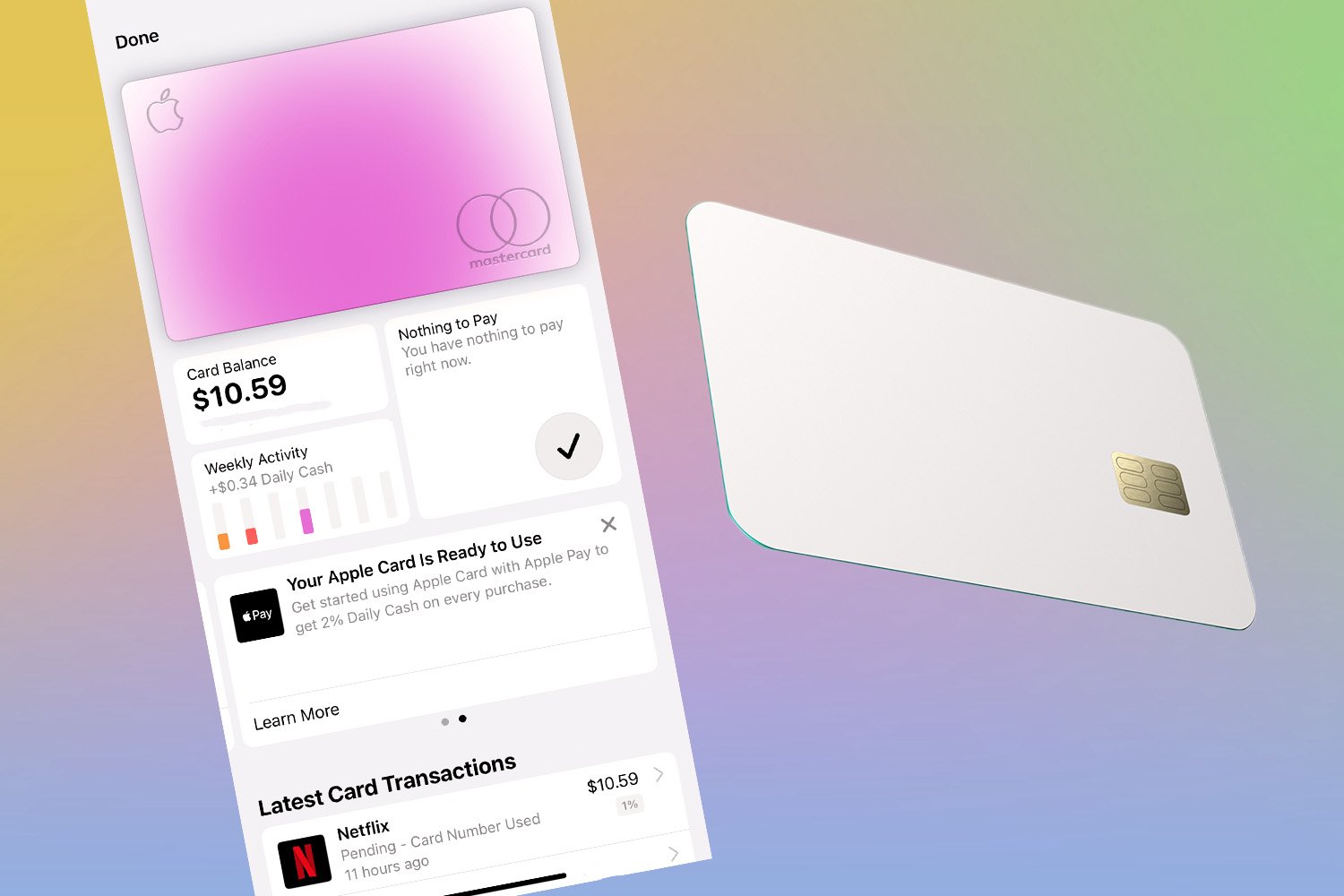

2. Card color on the iPhone

The color of the card turns ugly when you buy things like food and clothing. But things like donations, utility bills, and hospital bills make the card have beautiful green, purple, and blue tones. This might not bother most people but for me, it makes me feel bad for spending money.

3. No card number on the physical card

Interactive colors

Another issue I have with the Apple credit card is that there is no physical card number on the actual credit card. This makes it inconvenient to make purchases over the phone or online when there is no apple pay option. Some merchants not familiar with this can get confused. On one occasion a lady refused to swipe my card because there were no numbers on it. She thought I was into some type of fraudulent activity *sigh.

4. No fixed APR

Although fixed APR is a thing of the past for credit cards, some credit union banks still offer it for people with excellent credit scores. In Goldman Sachs Apple credit card defense though, the wallet app has nice visuals to help users of the card avoid paying interests altogether.

5. Can android users apply for the Apple credit card?

Provided you have a steady job, good credit, and satisfy other common criteria, there is one reason why you cannot apply for this particular credit card.

Things I like about the Goldman Sachs Apple credit card

1) No fees

Most credit cards offer this feature for the first year only. The Apple card on the other hand just doesn't have any fees. Like they say no annual, over-the-limit, foreign-transaction, or late fees. This is great especially if you are new to credit cards or are just trying to build your credit history.

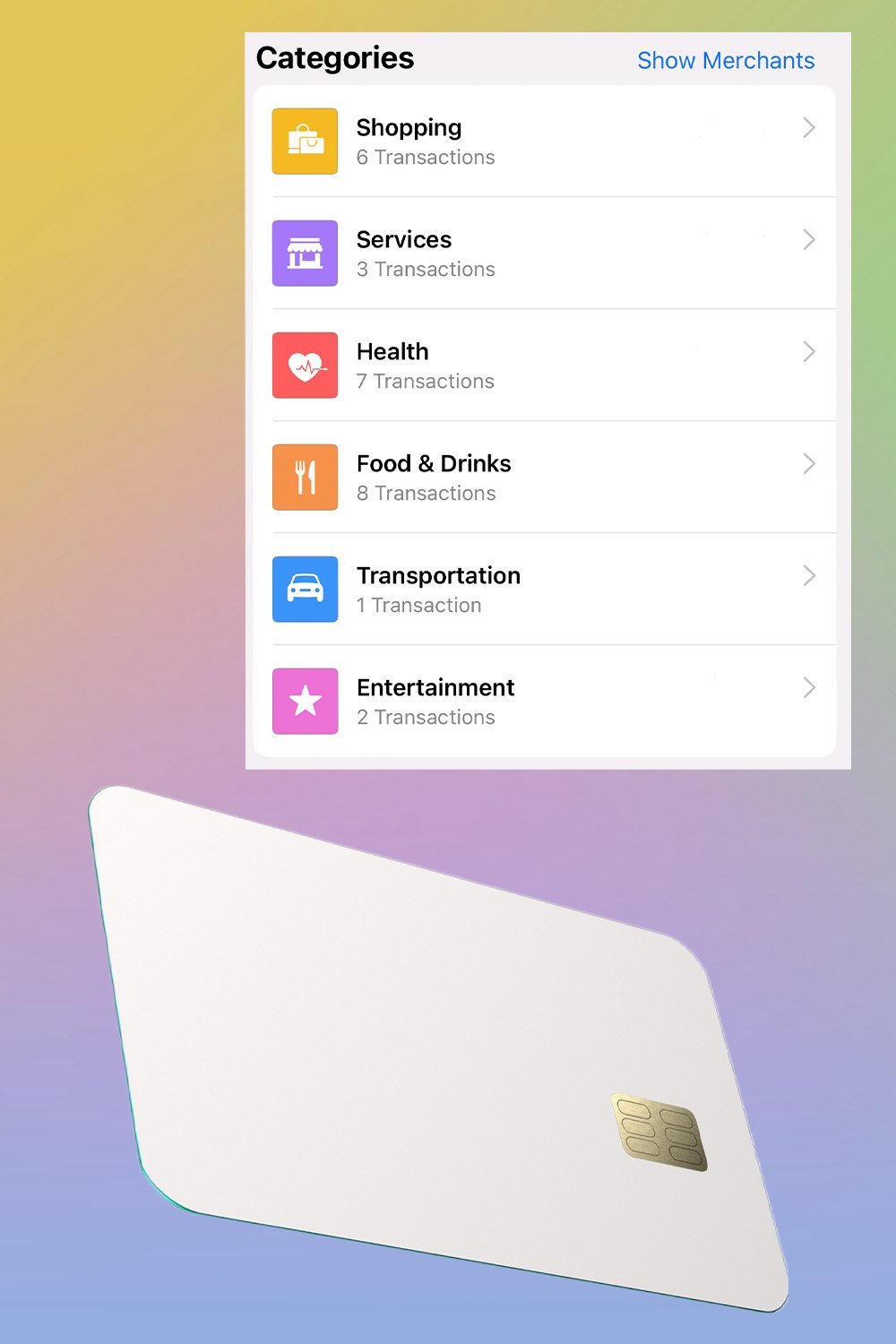

2) Great Rewards Program

The Apple Card rewards program is simple and easy to understand and just awesome. You get 3% cash back on all Apple purchases and 2% cash back on all other purchases when you use apple pay. Additionally, you get 1% back on every purchase.

3) No points just cash back

The Apple card really simplifies the cashback process. Instead of having to keep track of points, you just get cash back that adds up in your wallet over time. You can redeem your cash and use it to pay down your credit card, make purchases, or send money.

4) Customer service via text message

The very accessible 24/7 Apple customer service is convenient when you need to dispute a charge or just have a question. A customer service representative can help you right away via text message.

Also, you can easily track your spending and rewards on your iPhone. I like that I get a notification whenever my card is used, even for automated monthly bills. This helps me keep track of my bills and see which subscriptions I still need and which ones need canceling.

5) The design of the card is sleek and modern

I love the way people look at me after I hand them the card and they get to feel it. Apple physical card is made of titanium which has a nice feel to it. It's also kind of heavy (compared to other cards). Definitely a statement maker, simple, yet modern and sleek.

Overall, I have enjoyed using my Goldman Sachs Apple Credit Card. It has no annual fee, great rewards program, a nice design, and user-friendly customer service. The major issue I have found is the lack of travel perks. However, I think the features and benefits of this card far outweigh its few drawbacks. I would definitely recommend it to others iOS users!